Japanese-style 'The Great Decline' and its Implications for China

Date: 2022-08-08Views:

Via Zhang Xingxing ( Harvest Capital )

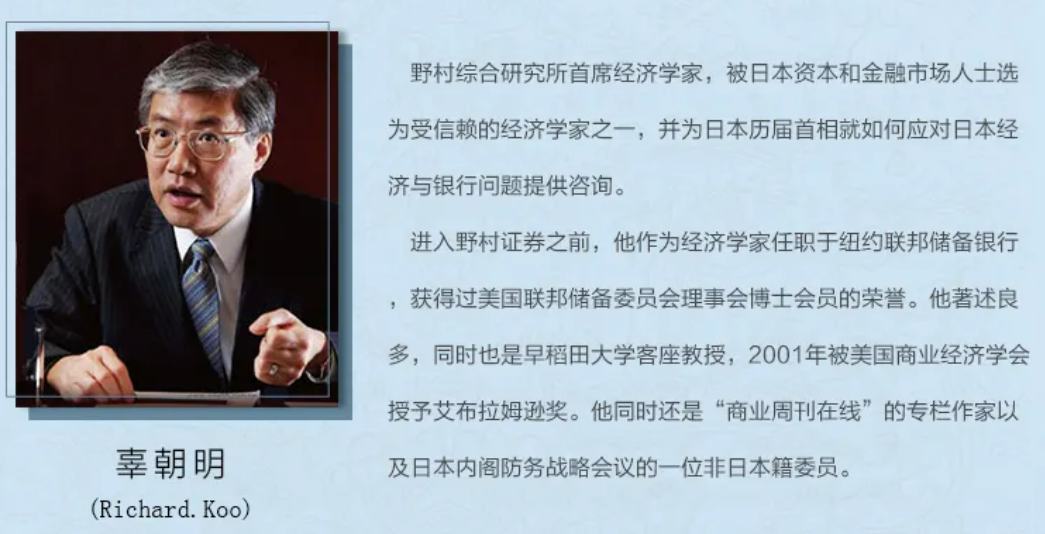

Nomura Securities Research Institute's Chief Economist, Gu Chaoming, in his works "The Holy Grail of Macroeconomics for The Great Decline" and "The Era of The Great Decline," starts from the background of Japan's significant economic decline. He investigates the underlying causes behind the recession, providing readers with a fresh perspective.

He starts by examining the smallest units of the economy, studying why the balance sheets of private enterprises and household residents are not expanding. He observes that after the burst of the asset price bubble in Japan, the private sector (both businesses and households) tried to reduce debt by means of profits and wages. Companies were reluctant to expand production, and residents were unwilling to consume, leading to further shrinking demand and an inability to absorb the supply. Even though the Japanese government continuously lowered loan interest rates, even reaching negative rates after the bubble burst, it could not stimulate corporate borrowing expansion. He thus concludes that monetary policy is ineffective.

The author further proposes that in the Japanese-style great decline, the public sector needs to use fiscal tools to expand and support demand, providing a policy for the private sector (including private enterprises and households) to recover. After the balance sheets are restored, the demand engine can then be shifted back from the government to the private sector.

In the book, the author mentions at least two types of economic recessions: one caused by economic cycles and the other caused by problems in the corporate balance sheet. In the former, companies still adhere to the goal of "maximizing profits," and monetary policy is the best tool to address such recessions. In contrast, when dealing with a balance sheet recession, the primary goal of companies is no longer profit maximization but minimizing debt. Fiscal policy is needed, relying on public sector spending to boost demand and stabilize the economy.

China's Macro Situation: How is it Different from Japan in Those Years

In the past two years under the impact of the pandemic, the scale of national fiscal personal income tax revenue has still grown by over 20%. Unlike the situation in the United States, where the attitude of homebuyers towards real estate and the protection provided by personal bankruptcy laws actively burst the bubble and cleared the market, stimulating new demand and driving economic growth, the situation faced by Chinese families is more akin to that of Japan. Even if not experiencing a comprehensive decline in residential property prices, for families whose assets have not appreciated, residential properties have essentially become liabilities. As institutions involved in investment and consumption, we are concerned about whether Chinese families are already substantively facing a decline in their asset-liability ratio, the possibility of future recovery, and the impact on the consumption industry.

Undoubtedly, real estate has been the core engine of economic development in the past few decades and a primary source of wealth growth for private households. Given the vast size and deep industrial structure of the Chinese economy, assuming conditions of a normal distribution, while some enterprises/families have seen their investments and wealth grow on paper (such as the income of wealthy Chinese families continuing to grow during the pandemic, and luxury home transactions remaining quite active in cities like Shanghai and Hangzhou), a larger proportion of families are facing declines in residential property prices (with overall stagnation and slight decline in real estate prices in hundreds of cities) and shrinking financial assets (losses in stocks and funds). For a broader range of households, the core driving force of their wealth growth has stagnated. When residences lose their wealth effect and become rigid liabilities, the asset-liability ratio of households essentially enters a state of decline. The reduction in wage income and the increase in unemployment during the pandemic have led to a decrease in the cash flow available for residents to repay mortgages, further squeezing consumer demand.

The core of the asset-liability ratio decline lies in the squeeze on household consumption demand caused by the rigid liabilities brought about by the bubble assets. Whether in Japan or China, its manifestations and mechanisms are similar. The Confucian cultural genes in both China and Japan are prominent, leading residents to be unwilling to let banks take away their houses, even if it means persistently repaying the loans. Additionally, China's personal bankruptcy system is not sound, and liabilities have an unlimited joint liability, making the path to relieve debts through personal bankruptcy less smooth. Therefore, the cash flow expenditure and repayment period for Chinese families are likely to be longer, and the impact of the decline in the asset-liability ratio on them will also be more long-term.

Financial assets possess a "money multiplier" effect. In recent years, the goal of financial regulation has been to lower financial benchmarks, but in essence, it has also reduced the multiplier effect of financial assets, diminishing the ability of the corporate sector to expand its balance sheet and the tangible wealth available to the household sector for consumption or investment.

China's capital market originated to address the financing issues of state-owned enterprises. The secondary market liquidity and appreciation of securities, as well as market value management, have also been considered for inclusion in the framework of state asset management assessment in recent years. From the perspective of state-owned asset control, the focus of evaluation is on income scale, asset size, and tax contributions, with stock prices not being the primary concern. However, whether for businesses or individuals, the stability of financial asset prices represented by stock prices is not merely a numerical value but realizable currency, a crucial component of their balance sheets.

When the operational cash flow of real businesses no longer steadily rises, various securities' prices based on them as underlying assets become unstable and decline. The decline in financial assets affects investment expansion and consumption capacity, thereby influencing supply and demand, reducing corporate income and profits. The spiraling decline is the process of economic recession.

Assessment of the Nature of Similar Situations in China's Economy

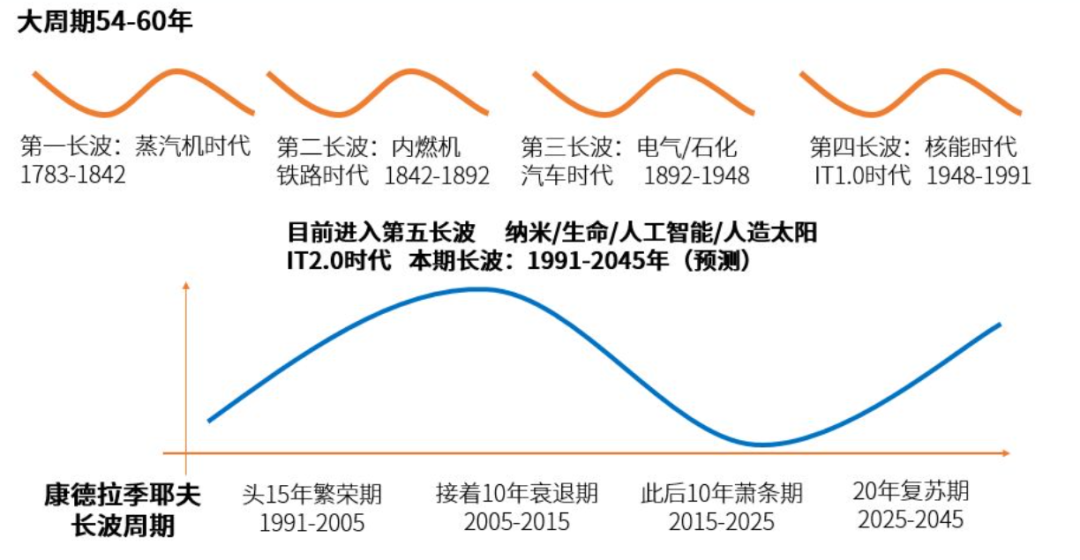

In the opening of "Tao's Cycle Theory," former Chief Economist of CITIC Securities, Zhou Jintao, mentioned that the longest cycle in the world economic cycle movement is the Kondratiev wave, completing a cycle of recovery, prosperity, decline, and depression every 60 years. China's economy experienced rapid growth for forty years. He proposed that starting from 2017, the world has been in a ten-year continuous transition from decline to depression, with the key turning point being the 2008 subprime crisis, which marked the shift from prosperity to decline. "The Great Recession" mentions that after the 2000 IT bubble in the United States, real estate was used to stimulate demand. The industrial sector underwent a bubble burst, but private enterprises and households continued to intensify property purchases under the stimulus of relatively low long-term interest rates. Ultimately, a real estate price bubble resulted in a supply disruption, subprime bond defaults triggered systemic risks in the entire financial system. The author believes that if the real estate bubble at that time could have been resolved in advance, or if it hadn't caused subsequent impacts of such magnitude. In 2008, China initiated the 4 trillion yuan stimulus plan, with real estate prices as the core asset continuously rising, driving continuous prosperity in related industries, and extending the overall economic cycle prosperity for more than a decade.

Since 2009, real estate prices in China have been soaring, with a comprehensive surge. However, after 2017, market differentiation became evident. The asset prices in core locations of core cities remained stable and continued to grow, driven by the imbalance in high-quality supply and unique social resource bindings. In contrast, property prices in other regions showed signs of fatigue. The period from 2017 to 2018 marked a prosperous period for the real estate industry in China. The country promptly implemented policies such as purchase restrictions and sales limitations to maintain the stability of land and property prices. The prices of existing second-hand homes experienced a decline, slowing down the onset of a normal industry cycle downturn. However, entering 2021, several real estate companies faced substantial defaults and financial crises, resulting in significant operational losses. This, in turn, led to a simultaneous decline in market value, bankruptcy, and a rocket-like decline in the balance sheets of private enterprises. Behind the defaults of real estate companies is the unfavorable sales performance of new homes, with a demand contraction far exceeding the companies' expectations. This situation highlights the contraction in investment and consumption expectations among ordinary households in China, reflected in the deteriorating balance sheets.

For the private sector (private enterprises and households), the recession we are facing may be a combination of economic cycle downturn and balance sheet recession. However, this time is different from the overall environment behind Japan's purely balance sheet recession in the past.

During the so-called "Lost Two Decades" in Japan, despite the competitiveness of Japanese products globally, such as home appliances, electronic consumer goods, and automobiles, the country maintained a trade surplus at the national level. Japan filled the gap left by the sluggish domestic demand by expanding overseas. Additionally, Japanese capital sought investment opportunities internationally, and by the end of the 20th century, it benefited from the boom in China, becoming a driving force in the world economy. Japan increased its investment in China, and its overseas assets enjoyed long-term market dividends and growth.

Returning to the current situation in China, the country's capital and production capacity going abroad are constrained by international and trade relations. It cannot fully replicate the macroeconomic favorable environment for Japanese enterprises' multinational investments during that period. The global pandemic has disrupted the global supply chain, causing demand fluctuations and unstable supply. External effective demand driving the economy is also facing competition from newly emerging Southeast Asian countries. However, China's new energy-related industries happen to be in a phase of global growth, with areas like electric vehicles, batteries, photovoltaics, energy storage, and wind power still thriving worldwide.

FOUR、Possible Response Strategies: Returning to the Old Logic

The wealth effect and moderate inflation are core driving factors of economic growth. In a normal cycle, a positive inflation rate prompts the private sector to seek higher returns on capital investments to offset the impact of inflation. Household savings shift towards investments, and businesses pursue the expansion of productivity. With the target of determined price increases, the return on investment surpasses inflation and the country's GDP growth rate. Moderate inflation can stimulate funds, capital, and supply production, leading to increased consumption in anticipation of positive wealth growth, further expanding total demand and initiating a new cycle of investments as a result of the wealth effect from rising asset prices.

Investment Institutions: What Can Be Done (Continued)

Guided by this book, through appropriate inferences, it can be concluded that China's economic regional imbalance has led to declining asset prices and insufficient consumer demand in some local areas. The current effectiveness of monetary policy in stimulating demand in the real estate sector shows no signs of improvement. Fiscal policy tends to focus on hard technology and infrastructure construction (both traditional and new digital infrastructure), industries that lay the foundation for the long-term development of the national economy and industries. In the short term, they cannot comprehensively stimulate and stabilize private sector demand. The overall recovery of the economy ultimately requires the recovery of private sector demand. From a medium- to long-term perspective, stabilizing employment, ensuring wage income, revitalizing existing assets, returning to the logic of asset growth and wealth effect are the keys to reversing the overall social demand.

From the perspective of primary market investment practitioners, funds can be allocated to areas that ensure the stability and expansion of the supply of essential consumer goods brands, safeguarding important consumption brands. It's essential to find industries with a rapid recovery of demand, where businesses can quickly expand after repairing their balance sheets. In the current historical context, investors must strengthen their judgment on the direction of policies; otherwise, they might end up in industries with a long-term L-shaped trend or enterprises that cannot emerge from a balance sheet recession for a considerable period.

Consumption is an industry with abundant cash flow and one of the industries with the highest cash turnover efficiency. From national policies and bank credit to the entry of investment funds into industrial projects, these factors help businesses in the industry overcome current difficulties, further driving cash flow and profit improvement in upstream industries, thus accelerating the repair of the entire society's private sector balance sheets. The resilience and rebound marginal effects of the consumption industry will be most pronounced, and the recovery of related financial assets will further drive the growth of household wealth, reversing demand expectations. Of course, the industry is filled with excess capacity and low-quality and inefficient (non-low-end) supply, and investors in the primary market should have the judgment to avoid being stuck with assets that will be cleared.

As China evolves into a K-shaped society, investments in the theme of consumption upgrades will shift toward brands that are more universal, creating convenience for a broader consumer base and meeting the national demand for various aspects of people's lives. These brands have relatively robust cash flows and asset turnover rates. In the situation of shrinking total demand, they may no longer expand, but they have the opportunity to take on more social responsibilities. Short-term profitability may be affected, but it is essential to believe that they will be among the earliest to recover and expand nationwide and even globally once demand improves.

During Japan's two decades of economic recession, it remained a country with a trade surplus. Japanese brands such as Uniqlo, Toyota, and Panasonic won global competition with quality and services. The growth of Chinese consumer goods during the economic expansion process is relatively easy. By seriously cultivating internal strength during this recession, improving products and services, and enhancing consumer welfare, Chinese consumer goods have a better chance of winning global competition. They can bring Chinese cultural lifestyles to the world when the demand improves.

"The Great Decline" conducts a macro-level study of balance sheet recessions, challenging traditional approaches to researching economic downturns and response strategies. By examining the rational behavior of private enterprises and households under the decline of balance sheets during economic downturns, valuable perspectives and methods for policymakers are obtained. To some extent, it also highlights the value of entrepreneurs, whose investment decisions in the broader context influence overall demand and the trajectory of the economy. In the current environment, entrepreneurs appear more precious, and the fundamental value of first-tier institutions lies in discovering enterprises, assisting entrepreneurs in achieving success. This has been the consistent belief of Harvest to be a business partner for entrepreneurs, investing with capital, and guiding with sincerity.

Related information