Believing in the power of value, Jiahua Weiye Capital has won the "TOP10 Investment Institutions in Chinas New Consumer Industry in 2017" for three times"

Date: 2018-04-24 Views:

On the evening of April 23, at the 12th China Investment Annual Conference Annual Summit hosted by China Investment Information, Jiahua Weiye Capital once again won the "TOP10 Best Investment Institution in Chinas New Consumer Industry of the Year". This is the third consecutive year that the institution has won this honor.

As the most influential event in Chinas private equity field, the 12th China Investment Annual Conference Annual Summit was held in Shanghai Jinmao Tower from April 23 to 25. This summit focused on topics such as the macroeconomic environment, industry development trends, and industrial investment hotspots. It invited Hu Zhanghong, chairman of CCB International, Liu Qin, founding partner of Morningside Capital, Song Xiangqian, founding partner of Jiahua Weiye Capital, Softbank China Capital Management Partner Hua Ping, Sequoia Capital China Fund Partner Zhou Kui and other leaders in the field of private equity investment, as well as representatives of leading industry entrepreneurs such as Li Bin, Chairman of Weilai Automobile, Zhang Kan, Chairman of Toubao Technology, Zhang Wen, President of Shang Tang Technology, Song Zhongjie, CEO of Tick-tock Travel, together with thousands of investment bank elites from hundreds of investment institutions, to discuss the ups and downs of Chinas capital market and the rational return of value investment with the theme of "the power of value", to clarify industry trends for investment institutions and inject more momentum for entrepreneurs.

At 8: 00 p.m., the "2017 Investment Industry List" expected by PE/VC was released. As a private equity investment fund focusing on large consumer services for more than 10 years in China, Jiahua Weiye Capital was named "TOP10 Best Investment Institution for Chinas New Consumer Industry in 2017".

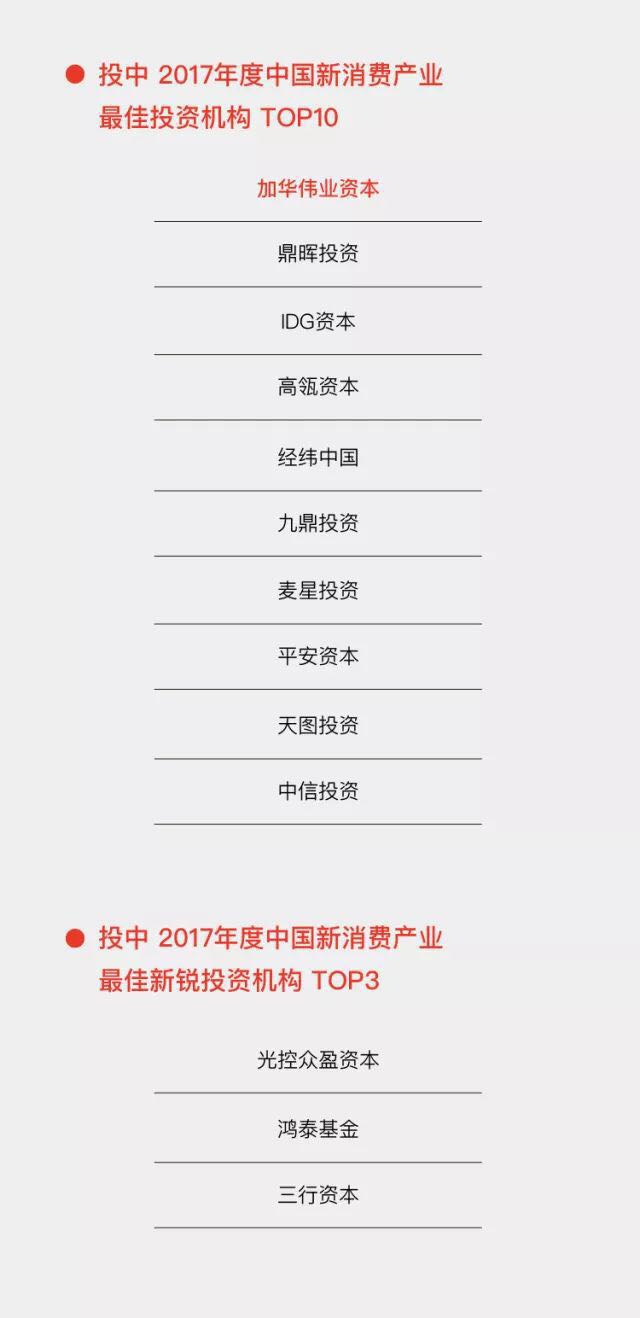

The following is the full version of the 2017 new consumer industry list:

Big consumption has become the biggest outlet of the investment industry, which is hard-won and natural.

Official data show that in 2017, Chinas total retail sales of consumer goods was 36.6 trillion billion yuan, accounting for 44.28 percent of GDP. Chinas economy has entered the "new normal", and the main engine that promotes economic development has changed from investment-driven to consumption-driven. "Big consumption, new retail, and consumption upgrades" have become the hottest topics in recent years.

What can be proved is that Song Xiangqian, the founding partner of Jiahua Weiye Capital, compared a data. After the industrial revolution, no country can be on an equal footing with the United States in total retail sales of social goods. Only China did it in 2017. Since its establishment in 2006, Jiahua Weiye has been adhering to the concept of focusing on value investment and helping Chinas consumption. It has promoted the development of leading enterprises in Chinas large consumer industry through real "enabling investment", and provided long-term and comprehensive financial solutions and strategic consulting services for such enterprises.

Jiahua Weiye Capital has been firmly bullish on "Chinese consumption" for more than ten years. It believes that China, as the worlds largest single consumer goods market, will surely produce worldwide consumer service companies. Song Xiangqian said that the most important thing for the investment industry, especially PE institutions, is not to blindly follow the trend and do nothing. Jiahua Weiye Capital has been carefully and patiently observing the large consumption areas closely related to the lives of ordinary people, focusing on "clothing, food, housing, transportation, eating, drinking, and entertainment." After determining the subdivision of consumer services for investment, benchmarking the worlds number one similar companies, and then looking for the domestic industry leading companies that are most likely to become the number one. Through the professional ability of financial services and the accumulation of industry resources for many years, we have served these leading enterprises in the whole process, helping them to enter the capital market and develop and grow into world-class consumer service enterprises.

The "2017 Investment Industry List" believes that Jiahua Weiye Capital has been like a day for more than ten years, always holding a "sparring" mentality, and exporting its own professional financial service capabilities and wealth with the method of good staff and good assistants. The resources of the consumer industry have effectively helped Chinese consumer service enterprises enter a healthy, rapid and sustainable development rhythm.

In todays biggest "tuyere" of big consumption, Jiahua Weiye Capital has successfully invested in many leading enterprises that consumers are familiar with, such as Incredible Home, Dongpeng Special Drink, Xinmei University, Meitu Xiu Xiu, Didi Chuxing, Love Underwear, Qiaqia Food, Add Soy Sauce, Laiyi Food, Hometown Chicken, New Pearl Ceramics, Orijin Metal Packaging, Gabriel Paint, Yebo Peak Decoration, etc.

The reason why we can "invest" in these "head enterprises" in these large consumer fields is that these enterprises are in great need of professional capital market services, and there are specializations in the technical industry. Jiahua Weiye Capital knows the consumer service industry best, and is also best at grafting industrial capital and financial capital perfectly, to really help such enterprises from private companies to public companies, from public companies to industry flagship, and even from industry flagship to world-class consumer service brands.

Jiahua Weiye Capitals ability to win the "TOP10 Best Investment Institution in Chinas New Consumer Industry in 2017" for three consecutive years is not only the power of time accumulation, but also the power of value investment.

"Where the consumer is, we will be there. Jiahua Weiye Capital will continue to focus on investing in big consumption and modern services to empower more Chinese consumer service companies. Working with these companies to respect and respond to consumers, China can also produce world-class consumer brands like Coca-Cola, Nestle, McDonalds, IKEA, Lipton and Red Bull over time", Song Qianqian is convinced.

Related information