"Consumer Evolution in Japan: Changes in the Dairy, Beverage, Baking, Beauty, and Processed Food Industries | Harvest Research"

Date: 2022-09-27Views:

We will divide the discussion into four chapters to elaborate on the changing patterns in the Japanese consumer industry.

Chapter 1: Patterns after "People" Change

Chapter 2: Patterns after "Places" Change

Chapter 3: Patterns after "Products" Change

Chapter 4: Implications of Japanese Consumer Evolution for China

In this issue, Chapter 3 will focus on the changing patterns of "Products" in five categories, studying trends in consumption:

1. Dairy Products

2. Beverages

3. Baking

4. Beauty

5. Processed Foods

Let's start with the conclusions:

1. Essential consumer goods are less affected by economic cycles, showing strong defensive attributes and resilience.

These categories are significantly influenced by price fluctuations. Essential consumer goods are less sensitive to macroeconomic fluctuations, depending more on their own competitive advantages. They have the ability to withstand economic downturns.

The food and beverage industry exhibits a certain degree of anti-cyclicality. Even in cases of reduced income, Japanese households are willing to cut other expenses rather than reduce spending on food and beverages. There is a significant rebound in spending when income increases.

2. Categories that meet human needs are more sustainable.

Consumers always seek convenient products and services, considering their health and personal appearance. Therefore, there is ample market space for processed and prefabricated food, functional health products (such as yogurt and carbonated beverages with nutritional and health functions), and beauty and skincare products. These categories continue to be popular in the era of rational consumption.

3. Each successful leap of "Products" is inseparable from accurate grasping of "Places" and "People" change factors.

Otsuka Group developed the Pocari Sweat sports drink based on its pharmaceutical background. In the 1980s, it took off with the rapid expansion of convenience stores and vending machine channels.

Suntory, constrained by the beer consumption tax and the decline in consumer purchasing power, developed the low-priced beer series Super HOP'S with low malt content but maintained a good taste, perfectly meeting the needs of consumers for downgraded consumption.

4. Continuous cultivation of niche categories in taste, texture, and functional premiums gives them more vitality.

Regardless of the consumer's stage, there is always a preference for novelty. Some categories inherently have the characteristics of deepening product value, such as toast-type staple bread. Through multiple product iterations, they can continuously improve taste and nutritional matching. Carbonated beverages can use upstream technology for taste and functional innovation, continuously adding new value to the product.

5. The penetration power of user circles will form an unbreakable brand aggregation force in the layers of economic cycle screening.

A brand equals social credit, and establishing credit endorsement is exceptionally challenging. If the entire society recognizes the brand represented by a particular product category, irrespective of age or gender, and the brand accompanies consumers through numerous ups and downs, this kind of credit becomes indestructible.

For example, in the dairy products category, yogurt has an exceptionally broad user base that has surpassed traditional user circles.

6. Opportunities need to be sought in large categories and markets.

Large market size, large categories, and low education costs are advantageous. Representative examples include Fuchijima Bread in the baking industry and Fancl in the skincare industry, both innovative enterprises. In other words, even established brands with certain strength need to find opportunities in large categories to make a difference.

Dairy products have a significant characteristic of having a broad audience. People with lactose tolerance can consume them as beverages or as breakfast items. Compared to beverages, dairy products have a wider user base, higher nutritional value, and a milder taste and texture, making them a rare category that appeals to a diverse audience.

The development of dairy products in Japan has undergone localization, leading to the emergence of segmented dairy products tailored to different consumer groups. This has made dairy products a category that transcends economic cycles.

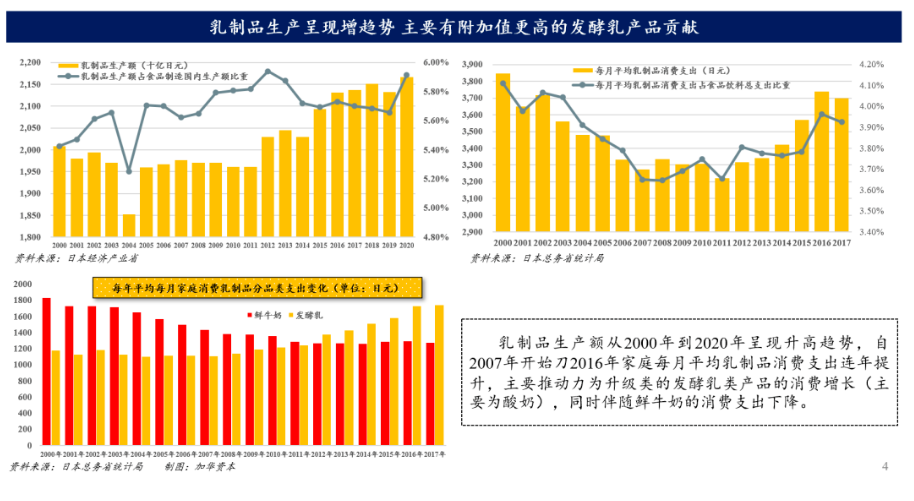

↑ Household expenditure on fermented milk gradually surpasses fresh milk.

Upgrading categories like yogurt and cheese drive structural changes in the dairy industry.

Segmentation and functionalization: From Morinaga's Aloe Beauty Yogurt to Meiji's PA-3 Gout Prevention Yogurt and Snow Brand's Visceral Fat Reduction Yogurt, new yogurt products consistently address national health concerns, becoming exemplars of the everyday incorporation of functional foods.

In addition, the refined taste, local ingredients, seasonal limited editions, and the perfect fusion of Western and Japanese styles reflect the unique thinking and innovation of Japanese yogurt companies.

The three major dairy giants in Japan (Meiji, Snow Brand, Morinaga) exemplify how to adapt to societal development, gradually localize foreign foods, and elevate the consumption and innovation levels of Japanese yogurt in Asia. Their market insight, relentless scientific research, and attention to product details are the foundation that has allowed Japan to become a yogurt-developed country, and it is something worth earnestly learning from.

From a consumer perspective, the Japanese yogurt industry is evolving from mass consumption to personalized consumption, showing trends of individualization, diversification, upscale orientation, and branding.

Key factors for the success of Japanese yogurt: the fusion of Japanese and Western flavors in ingredients; creating uniquely Japanese yogurt; prominent products targeting health-conscious groups, especially the middle-aged, elderly, and female demographics; foundational research on preserving probiotic strains.

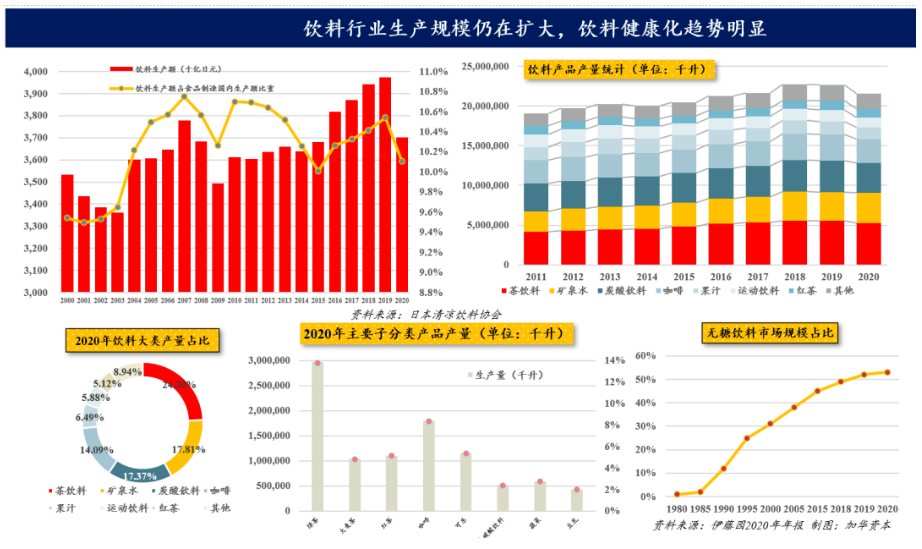

Beverage consumption is not significantly affected by economic cycles (essential, low unit price, easily accessible convenience).

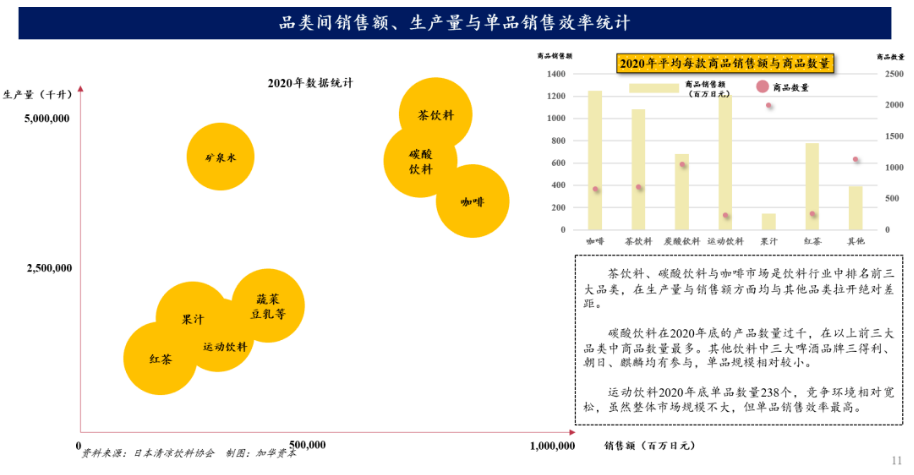

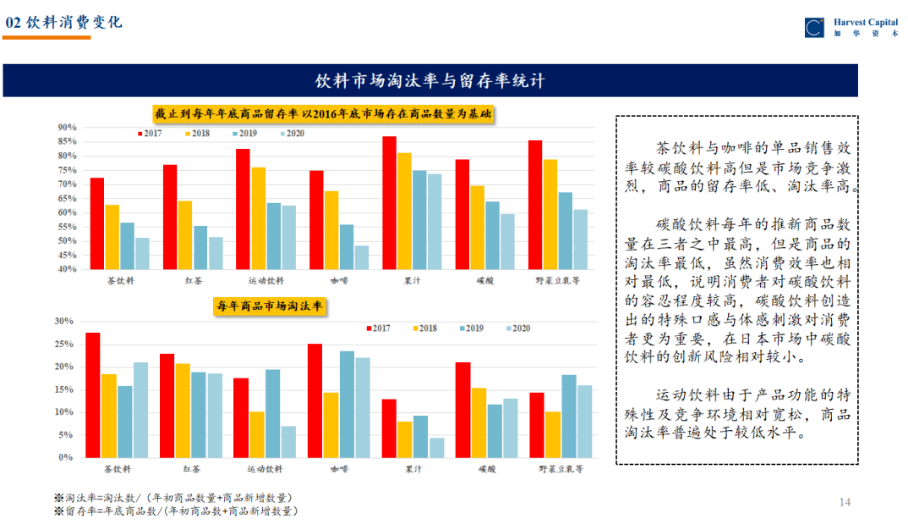

In the past 20 years, the top three categories in the Japanese beverage industry are tea drinks, mineral water/carbonated drinks, and coffee drinks. The market share of sugar-free beverages (tea drinks, mineral water, black coffee) exceeds 50%, indicating a clear trend towards health. Sales efficiency and elimination rates vary between different categories.

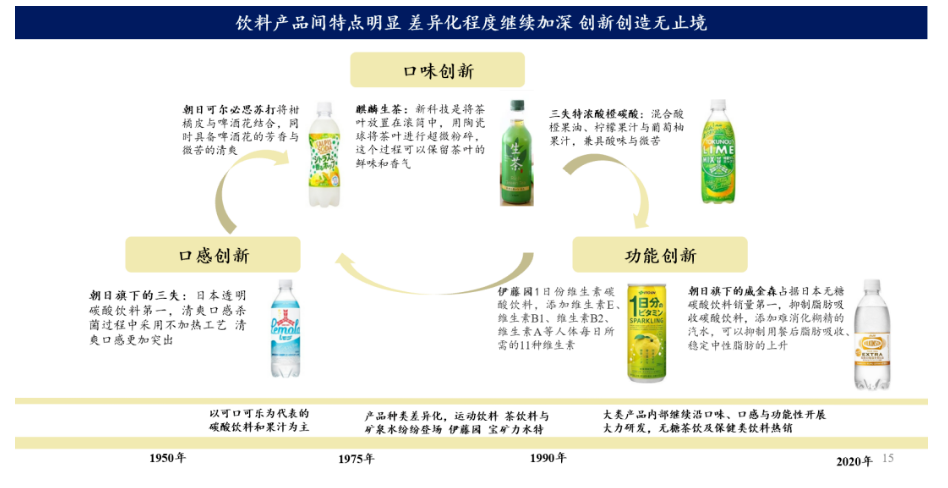

Innovation in the beverage industry is concentrated on taste, texture, and functionality.

The domestic beverage market in China has similarities to the development in Japan. Yuanqi Senlin (元气森林) initially adopted a Japanese design style, focusing on sparkling water and tea drinks. Nongfu Spring (农夫山泉) has also introduced brands like Dongfang Shuye (东方树叶) and Chaπ, emphasizing the health concept of tea. However, the competition in the Chinese beverage market is far less intense than in Japan.

The innovation in the Japanese beverage industry primarily focuses on three aspects: flavor, texture, and functionality. The characteristics among beverages are distinct, and the degree of differentiation is becoming increasingly pronounced.

03 Baking

Summary:

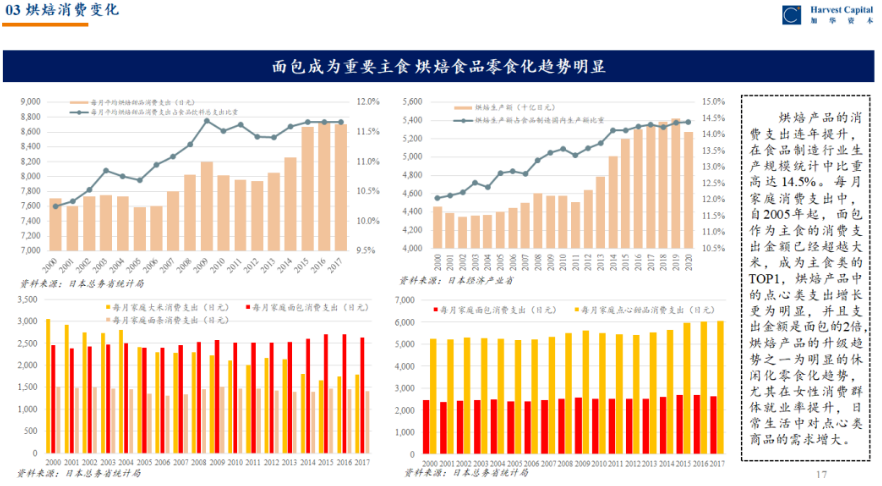

1. Since 2005, bread consumption in Japan has surpassed that of the staple food, rice. Additionally, expenditures on baked snacks are twice as much as on bread. This trend is related to the increased purchasing power of employed Japanese women, highlighting a clear shift towards baked snacks.

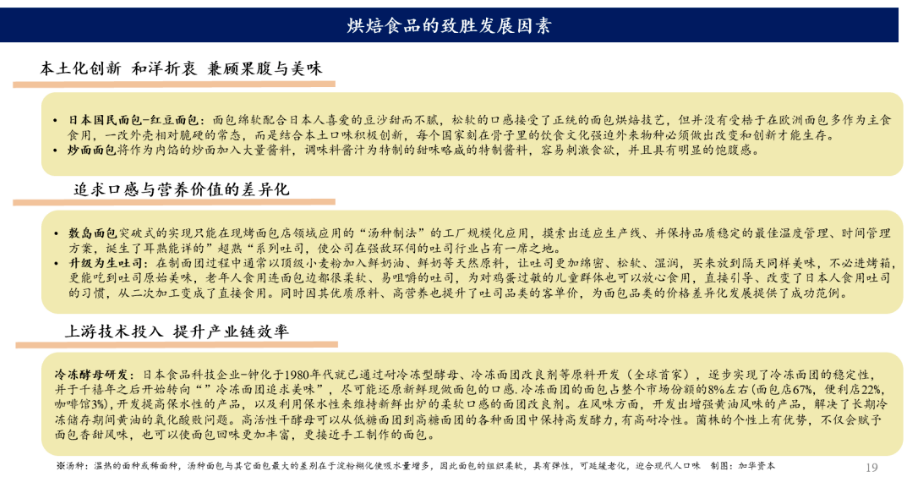

2. Baking needs to be rooted in localization. Japanese people prefer sweet buns over Western-style pastries, representing a combination of staple food and baking. Representative products include red bean buns, pineapple buns, and cream buns with fillings. Localized bread still dominates the market.

3. Innovation should go beyond just category and taste; low barriers to entry make it easy to imitate and may not bring high profits.

China's bread industry has evolved over the past 20 years, starting with the Westernized cakes. However, localized baking brands, such as Daoxiangcun, Luxihe, Zhanji, and Nanyang, specializing in Chinese-style baking, still dominate the market in terms of the number of chain stores.

From this perspective, both Japanese and Chinese baking developments are rooted in localization, adapting to local preferences and tastes.

However, in the process of modern Westernization in Japan, baking was not a mere imitation of Western-style bread. For example:

During Japan's Meiji era, when European yeast for making bread was not widely popular, the breadmaker Kimura Eizaburo used the sake leaven from traditional Japanese confections called "sake manju" to make bread. He then replaced the European-style bread fillings with traditional red bean paste (as red beans were considered an elegant symbol at the time) and added a touch of Japan's pickled cherry blossoms. This gained praise from the emperor and became popular. Subsequently, with the advocacy of societal culture, bread developed into a food that could be a staple, fill one's stomach, and be made into desserts, accumulating a strong sense of localization.

While Japan's culinary culture is relatively shorter compared to China's, Japan remains at the forefront of food product development. Today, the revival of traditional Chinese pastries focuses mainly on traditional categories such as peach pastries, cakes, and cream puffs. It emphasizes "making Western-style pastries with Chinese characteristics." While there is innovation in ingredient selection, the exploration of traditional aspects still lacks sufficient effort.

04、Beauty and Cosmetics

Summary:

1. The three major categories in the Japanese beauty and cosmetics industry are skincare, hair care, and, finally, makeup.

2. Skincare (essence) is a core category in the beauty and cosmetics sector, serving as a foundational and functional product, occupying a dominant position in beauty product offerings.

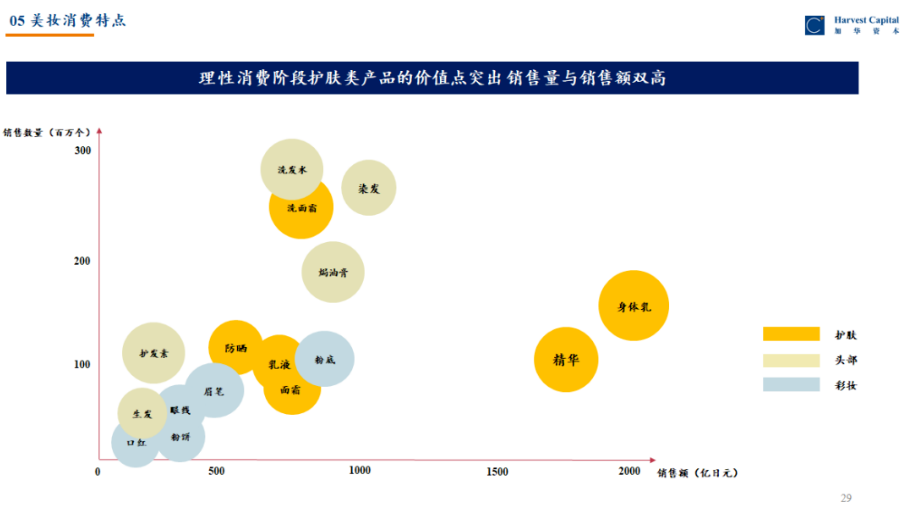

Top-selling Beauty Products in Japan in 2021: Body Lotion and Essence

In 2021, the sales rankings for individual beauty products in Japan were dominated by body lotion and essence. The Japanese culture of enjoying baths and showers contributes to the high demand for body lotions, making them extremely popular. On the other hand, essence, known for its potent skincare benefits, secured a leading position in the beauty market due to its functional excellence. Additionally, within the makeup category, high-tech foundation and face powder products held significant market shares.

Many new domestic brands in China start with single products such as face masks, facial cleansers, and cosmetics. They gain traction quickly and exhibit strong substitutability. In contrast, many high-end serums in Japan have become globally renowned brands, representing functionality, research and development capabilities, and brand strength.

In the era of rational consumption, Japan's top 10 categories are mostly related to functionality. The chart below categorizes them into three classes: skincare, head care, and makeup, using different colors for representation

Beauty and cosmetics belong to products with a strong spiritual attribute, carrying a profound sense of value identification. The research and development as well as brand construction of these products require a long-term accumulation of time. Many beauty brands in Japan have a history of a hundred years, with names like SK-II, CPB, and Decorte even conquering the European market.

To establish a core advantage in the beauty industry, it's essential to build barriers in the skincare field, a rule set by major brands like L'Oréal, Estée Lauder, and Shiseido. Fortunately, there is a growing number of outstanding single products in China, such as hyaluronic acid from Huaxi Biologics and the Perlaya Ruby Cream, that mirror these successes.

05、Processed Products

Summary

The market size of prefabricated staple foods is growing, occupying over 40% of overall prefabricated food expenditures.

The growth of frozen processed foods is primarily driven by non-fried products on the consumer-to-consumer (2C) end. Among these non-fried frozen foods, traditional products in various staple food categories (noodles, fried rice, dumplings) show a clear overall growth trend.

The trend of externalizing diet is evident.

Processed foods, due to their convenience, ready-to-eat nature, and quick preparation, are highly popular in Japan.

A noticeable trend is the externalization of diet, meaning having meals outside rather than cooking at home. Examples include dining out, ordering takeout, and bringing home processed foods from convenience stores, all of which represent the externalization of diet.

More people are choosing to eat in ways such as dining in restaurants, ordering takeout, and bringing ready-to-eat foods from convenience stores. Products like instant noodles and rice balls from Nissin that can be self-heated or eaten cold are becoming increasingly popular.

The societal reason for the trend of externalizing diet is that takeaway dining products solve the cost of a meal, which is lower than the cost of cooking at home. In Japan, where labor costs are high, the production efficiency of ready-to-eat foods is higher, and there is greater potential for cost optimization. In the long run, the choice between restaurant consumption and processed foods for consumers essentially boils down to the interplay of price and taste. The outcome depends on the capabilities of both restaurant and food processing enterprises.

Conclusion

As operators in various product categories embark on entrepreneurship, deep consideration of the chosen category is essential, contemplating whether it can accommodate innovation demands and if it allows for in-depth cultivation. Throughout the entrepreneurial journey, continuous reflection on how to enhance the vitality of the chosen category and carry more innovative elements is crucial. This is a process of sustained cultivation and refinement.

For example, milk can continuously create product differentiation and functionality. Essence products can establish ongoing research and development barriers and brand barriers. The emergence of baked red bean buns is rooted in fermentative innovation and borrowing from traditional ingredients. However, process innovation is easily imitated, leading to low industry concentration.

In OCC's 2021 Global Top 50 Fast-Moving Consumer Goods Enterprises report, Yili, with a market value of two hundred billion, was recognized as the largest FMCG company (excluding supply chain companies like Shenzhou International). Dairy products cover all age groups and represent a classic product. In less economically developed times, Yili occupied the minds of the older generation, representing a classic. In the era of economic prosperity, through continuous innovation, Yili has introduced many new products, continuously capturing the minds of the younger generation. Today, the majority of Chinese consumers still have a special fondness for Yili.

This is something many new consumer companies need to gradually accumulate. Many "high-end" brands, through temporary marketing efforts, have approached consumers' attention, but there is still some distance from entering consumers' hearts.

In the long river of the birth of a big brand, there will be many challenges, but also opportunities. Consumer goods companies should not be discouraged during economic downturns. This is the worst of times, but also the best of times. The process of a brand crossing cycles is also the process of winning hearts, which is close to "Tao." As evidenced by Dongpeng Special Drinks, a company invested in by OCC, giving drinks to truck drivers during the pandemic is also an expression of entering consumers' hearts.

The wave of entrepreneurship for new consumer brands in China began to erupt in 2019. Without experiencing a complete cycle and with short iterations, new consumer companies need some time. I believe that in the not-too-distant future, we will see many domestically produced new consumer brands that surpass cycles. How long it will take is something we eagerly await.

Related information