The transformation of consumer patterns in Japanese society: Basic principles following changes in "people".

Date: 2022-09-29Views:

Taking ancient lessons as a guide, we can understand the rise and fall. Our neighboring country, Japan, shares similarities with China in terms of income levels, population structure, and consumer choices. To some extent, we can draw on Japan's trends in consumption to anticipate opportunities in China's consumer market.

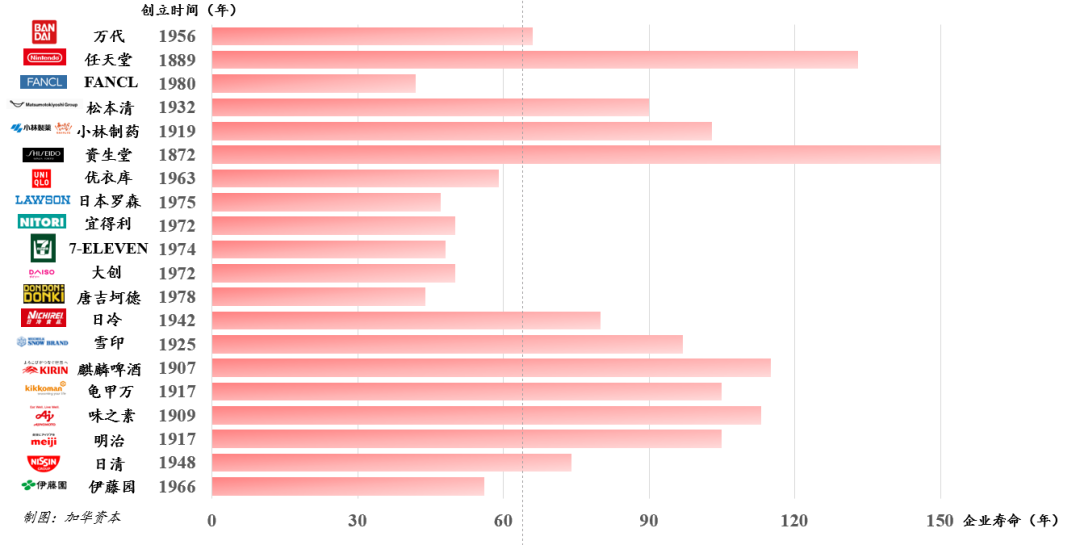

At Harvest Capital, we have observed that Japanese consumer brands, after going through several economic cycles, exhibit a notable resilience to economic downturns. What insights can this provide for Chinese consumer companies? In the upcoming series, we will share insights into the evolution of Japanese societal consumption and its implications for China.

We will be presenting the changing patterns in the Japanese consumer industry in four chapters:

Chapter 1: Patterns After Changes in "People"

Chapter 2: Patterns After Changes in "Places"

Chapter 3: Patterns After Changes in "Products"

Chapter 4: Implications of Japan's Consumer Evolution for China

In this edition, we will delve into the first chapter, exploring the patterns following changes in "people."

The patterns of change behind people's behaviors are discovered through a combination with the macro environment.

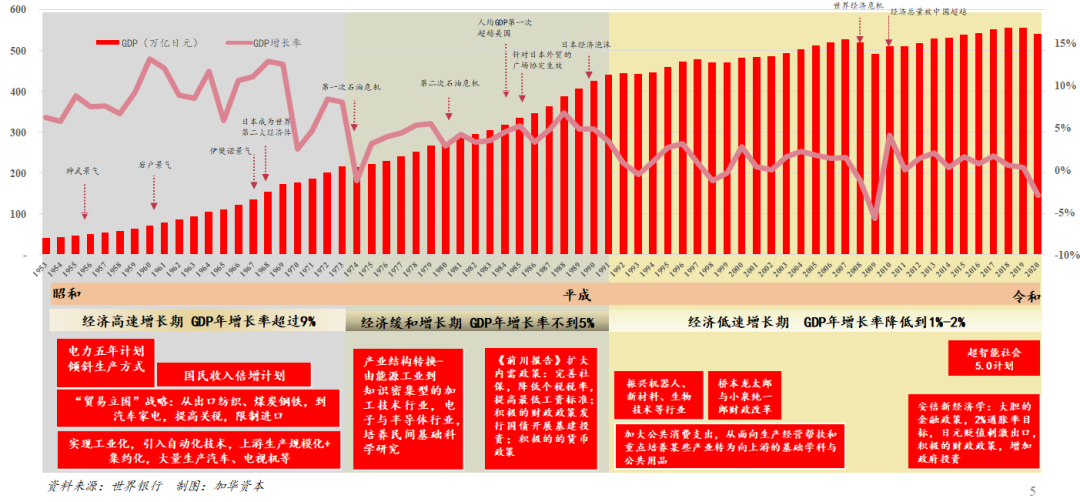

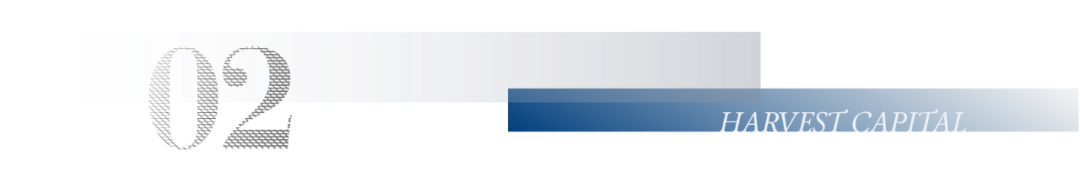

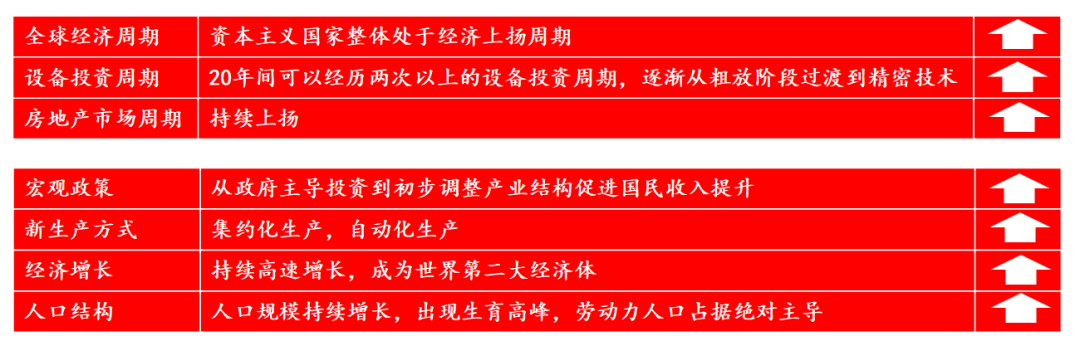

1. Japan rapidly achieved industrialization, and its development transitioned from fast to slow. In the early and middle stages, government industrial policies had a profound impact, while in the later stages, it was largely influenced by the industry and demographic structure.

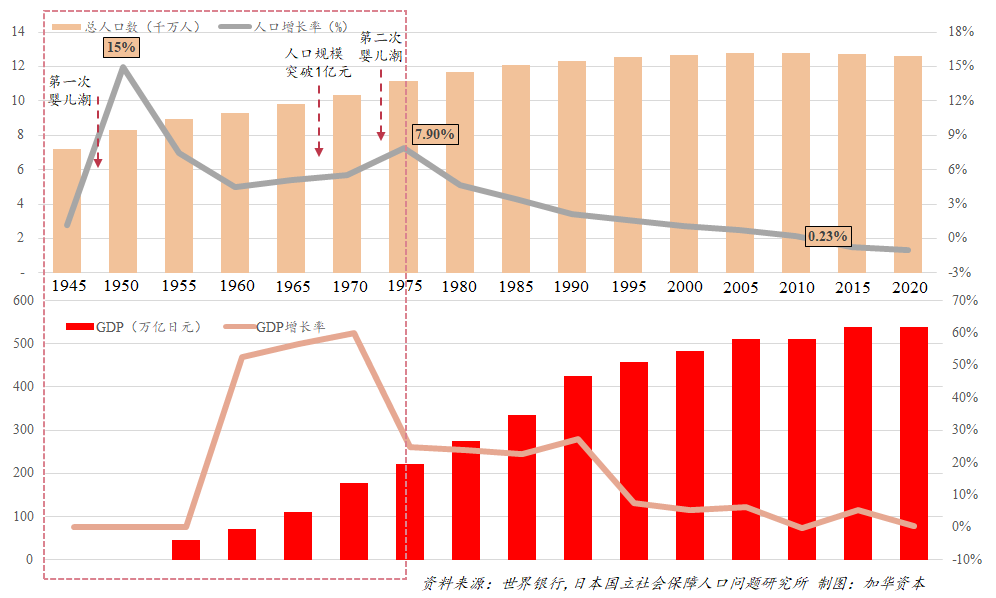

2. During Japan's economic growth period, it highly coincided with the rapid growth period of the population.

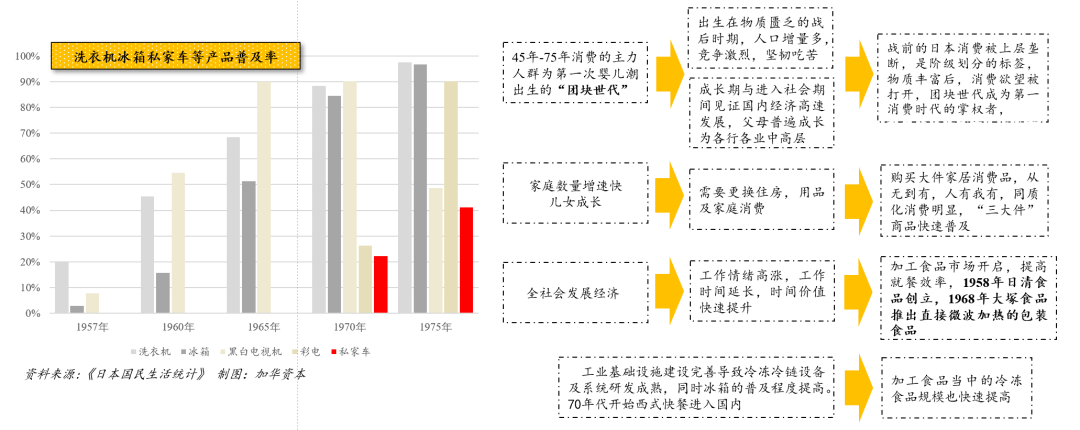

Between the 1950s and 1970s, there were two peaks in childbirth. The early increase in population facilitated the absorption of the investment results of rapidly growing industrial enterprises. It also strongly supported the Japanese government's policy of expanding domestic demand, gradually forming an economic growth model dominated by consumption-driven factors.

Afterward, Japan's population stabilized at around 120-130 million, and the birth rate gradually declined. In the later period, with a decreasing birth rate, the phenomenon of population aging became more severe. Residents' willingness to consume decreased, leading to slow growth in the domestic economy.

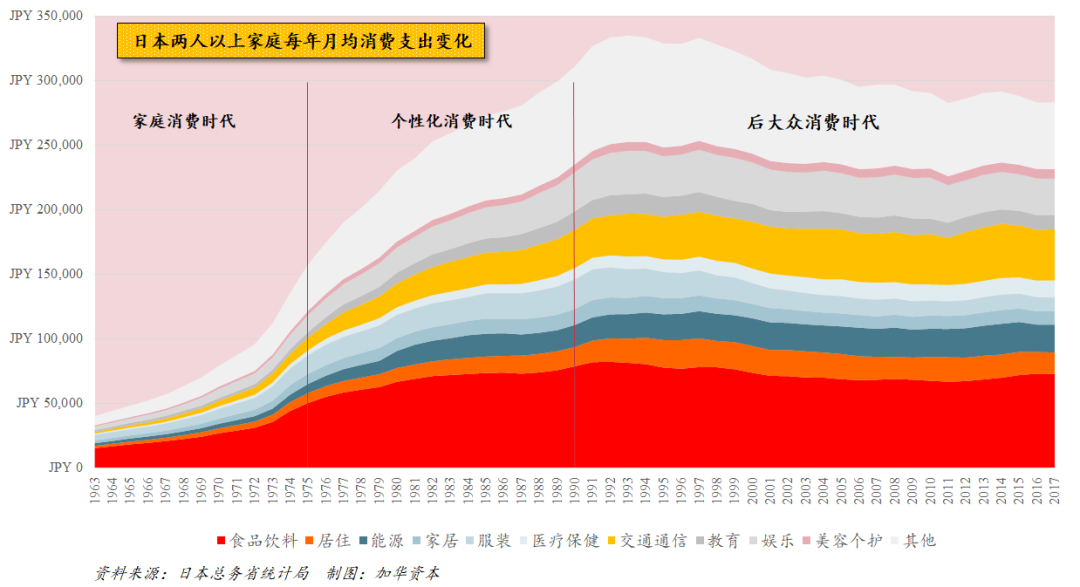

3. Household consumption trends transition from basic needs to spiritual service demands, with overall demand slowing down in the later period.

In the final stages of rapid economic development (around 1975), household consumption expenditures surged, marking the beginning of the mass consumption era. During the period of slowing economic growth (1975-1990), various consumption demands rapidly expanded, with faster growth in expenditures on upgraded spiritual services. This reached its peak around the 1990s, followed by a slow decline in overall consumption expenditures until stabilization.

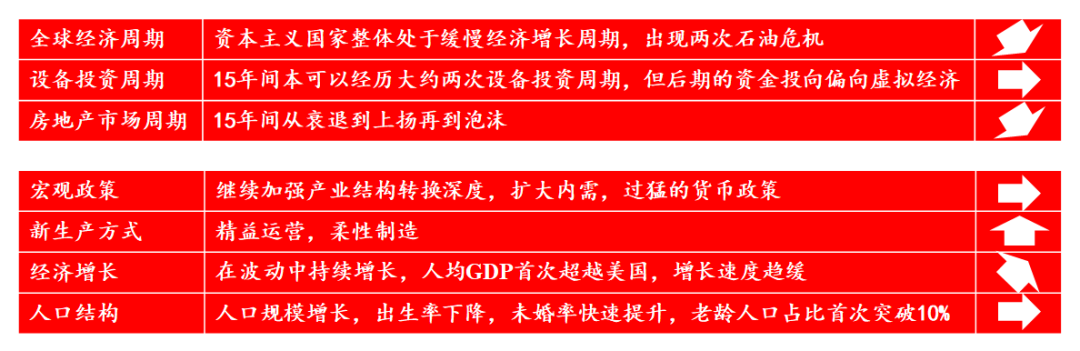

Aligned with the three major development phases of the Japanese economy and the cycles of changes in consumption expenditure amounts, the post-war Japanese societal consumption stages can be divided into three main phases:

1. The First Stage: The Era of Household Consumption (1945-1975)

2. The Second Stage: The Era of Individualized Consumption (1975-1990)

3. The Third Stage: The Post-Mass Consumption Era (1990s to present)

The Era of Household Consumption

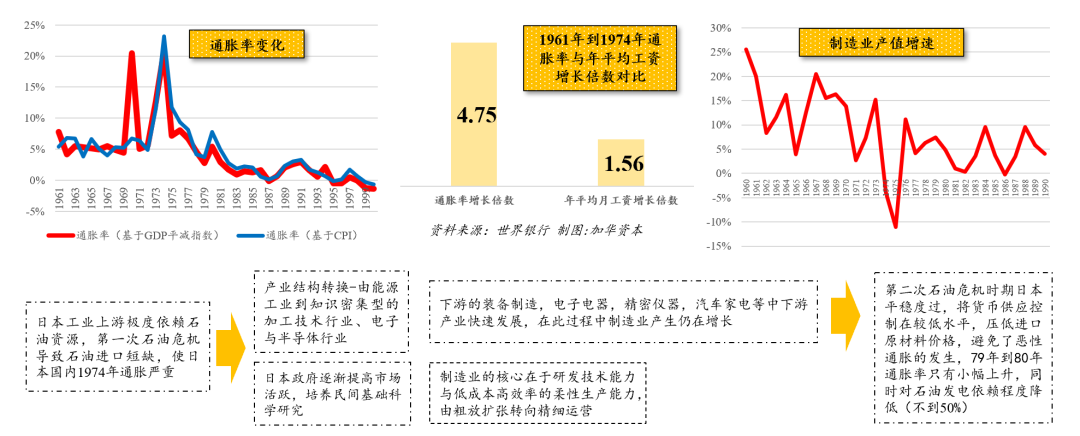

1、industrial policy investments dominated Japan's industrialization from takeoff to maturity, with peak economic development at the beginning.

Due to early shortages of coal and electricity affecting production in Japan, the government led a 5-year plan for electricity and tilted the production method, leading to rapid growth in the manufacturing industry's output. For example, in 1973, three-quarters of Japan's energy demand was oil, with oil imports accounting for 99% of total demand. As the manufacturing industry's industrial output increased significantly, it needed to be absorbed by internal demand, prompting the government to issue a 10-year plan to double the national income. Subsequently, Japan completed the stages of industrialization from takeoff to maturity. In 1975, the per capita GDP was 1.98 million yen, 2.6 times that of 1960.

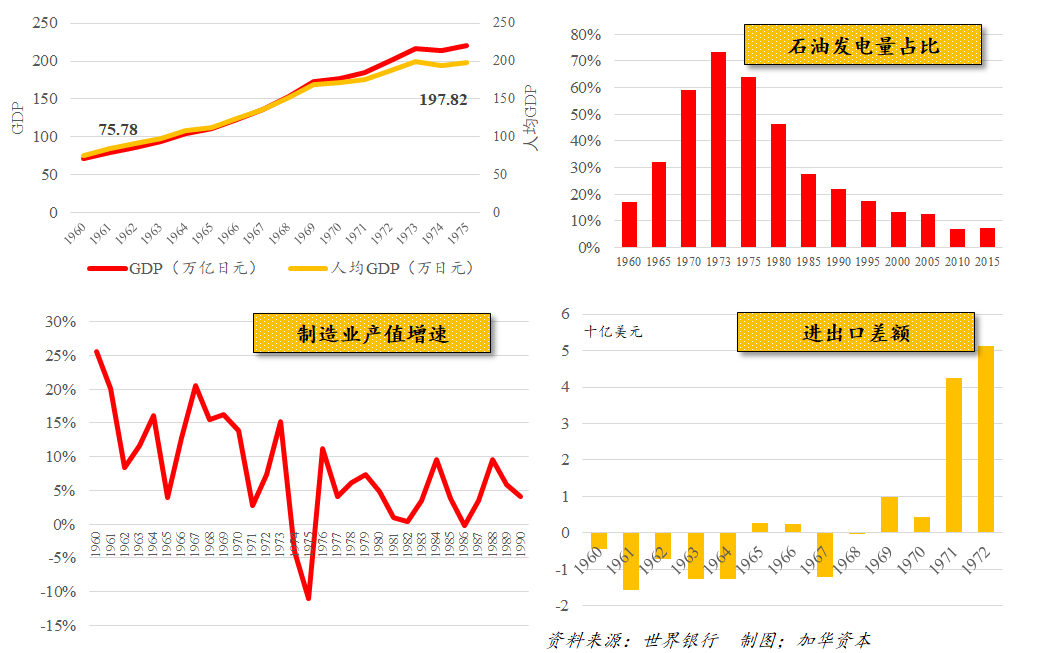

2. The Peak of Urbanization with Continuous Upsurge in the Real Estate Market

The continuous development of the steel industry and the improvement of industrial scale and intensive production capabilities have led to the rapid maturity of the construction industry.

Industrial clusters gradually formed, and the population density in areas around the industry increased, with industrialization promoting the increasingly perfect construction of supporting infrastructure for daily life.

日本的城镇化发展水平快速,在1975年之前城市人口数量增长快速,城市化率已经达到70%以上水平,居民对住房需求旺盛,房地产行业也迎来长期景气发展阶段,国民收入水平在1960年到1970年实际平均工资增长83%。

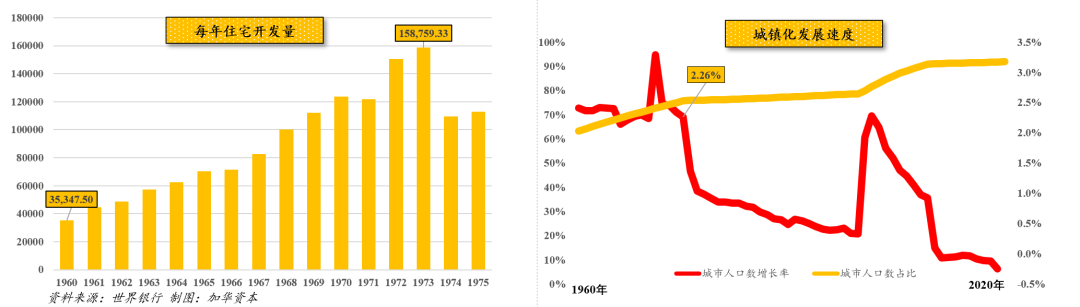

3、Dominance of Population with Production and Consumption Capabilities, Mainly Large Family Structures

Japan's urbanization level developed rapidly, with the urban population growing quickly before 1975. The urbanization rate had already exceeded 70%, and there was a strong demand for housing. The real estate industry entered a long period of prosperity, with the average real wage increasing by 83% from 1960 to 1970.

After two baby booms post-World War II, the second one occurring between 1971 and 1974, the descendants of the first baby boom entered the childbearing age. During this period, the Japanese government did not actively encourage childbirth and even implemented policies to restrict it. This was done to prevent sudden population increases leading to a rapid expansion of demand and subsequent inflation. With fewer people in each household, the living standards of individual residents could be higher.

Before 1975, Japan's population steadily increased, and there was an abundant labor force. Although the proportion of elderly people started to rise continuously, the presence of two periods of high birth rates meant that the dominant population had both production and consumption capabilities. The majority of families had more than three members, and large family structures were still prevalent. The growth rate of core family numbers was at its historical peak.

4. Entering the era of personalized consumption: Mass production, mass consumption, and homogeneous consumption.

Era of Individualized Consumption

1. The oil crisis compelled Japan to optimize its industrial structure and enhance operational efficiency with precision.

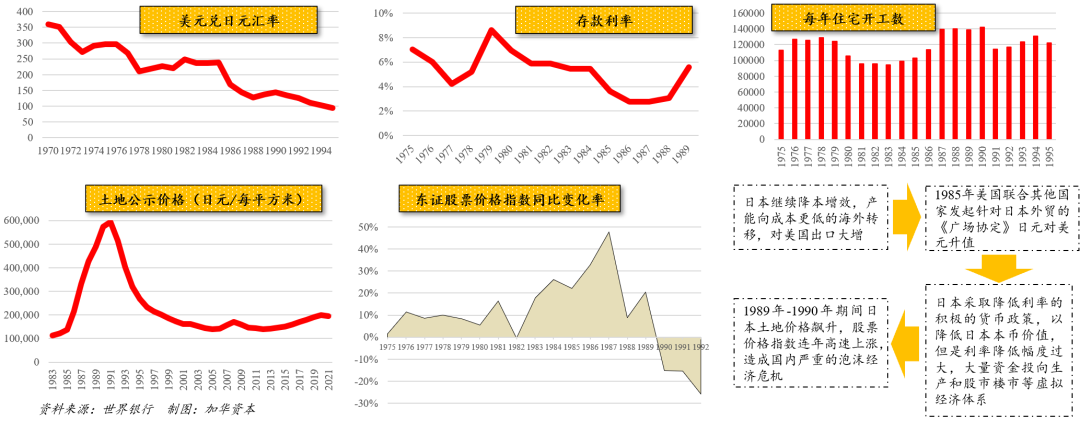

2. External constraints and serious errors in internal regulatory policies led to the bubble economy crisis.

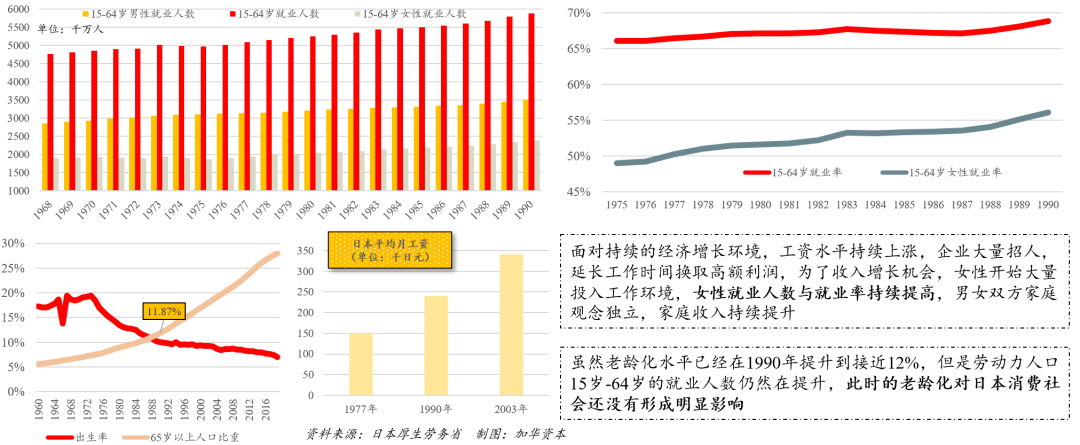

3. The number and employment rate of female workers increased significantly, fostering a sense of independence and contributing to additional household income.

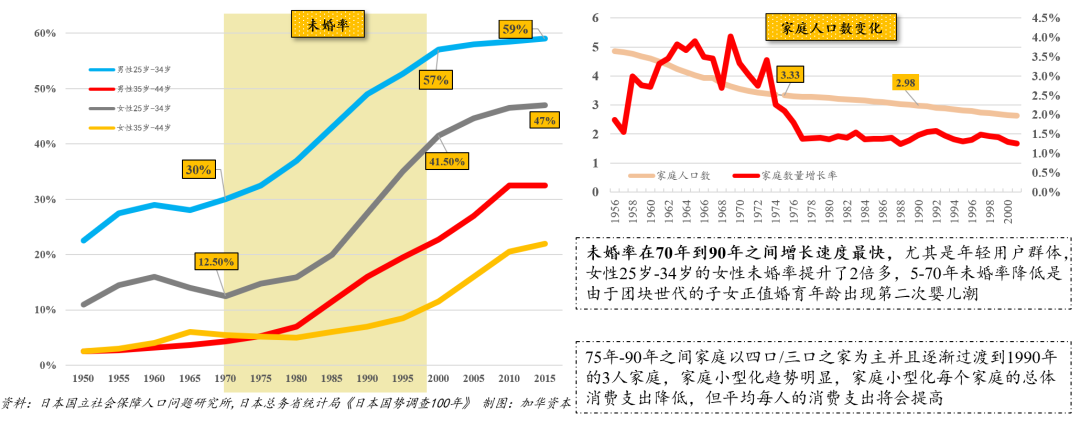

4. The trend towards smaller households and an increase in the unmarried rate positively influenced consumer spending power.

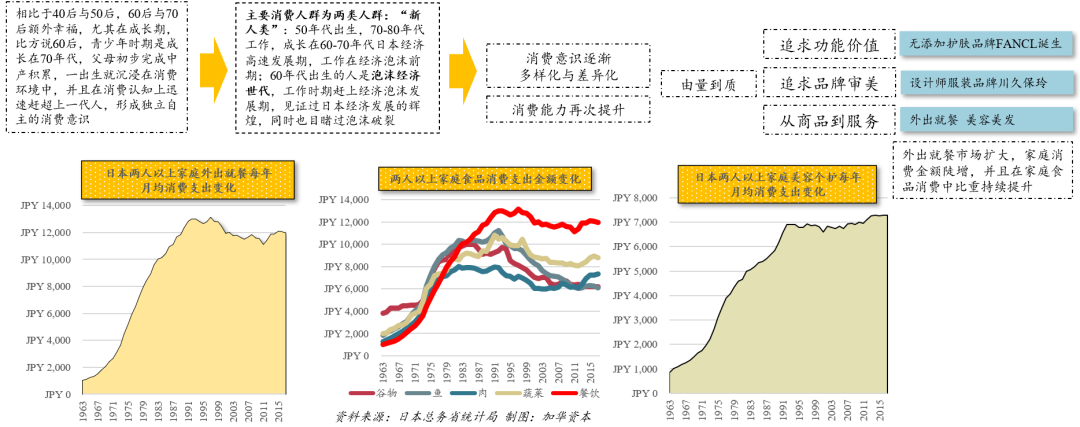

5. Entering the era of personalized consumption, there was a shift from quantity to quality, with a focus on brands and differentiation.

6. There is a growing confidence in local brand culture, with a pursuit of both foreign brands and luxury items, seeking the ultimate balance between quality and cost-effectiveness.

Post-Mass Consumption Era

1. Economic conditions experienced a downturn and recovery, with no significant change in residents' wage income.

After the economic bubble, the government set a total limit on real estate financing. The introduction of a land tax and increased interest rates led to bank defaults, business closures and liquidations, a significant decline in stock prices, shrinking demand, and numerous business closures. The frequency of mergers and acquisitions in the market was deeply affected by the economic bubble and tended to be conservative.

During this stage, Japan did not seize the opportunity to adopt new production methods, such as global opportunities in ICT, big data, and the Internet of Things. There was a shortage of talent in these industries.

Abenomics stimulated domestic demand, continuously increased public consumption investment, gradually relaxed constraints on social capital in research and education, and showed signs of economic recovery. However, overall wage levels did not increase.

2. Japan is experiencing super-aging, declining birth rates, and an increase in single-person households.

The aging process in Japan has been rapid, continuous, and profound. With an increase in life expectancy, urbanization, rapid industrialization, rising incomes, and the promotion of the tertiary sector, there has been significant progress in medical services. However, the cost of caring for the elderly has increased. The country is facing serious issues of unmarried individuals, declining birth rates, accelerated family downsizing, and a significant proportion of single-person households, reaching close to 35%.

3. Consumer Contributions to Economic Growth Remain Stable, with a Noticeable Decline in Consumption Motivation Among the Elderly

The main consumers of food products are household heads aged between 30 and 70 years, and the aging population shows a clear decline in consumption of processed and restaurant foods.

Households with heads aged below 50 contribute the most to restaurant consumption, especially those headed by individuals aged 30 to 39.

Households with heads aged 60 and above have the highest proportion of spending on food, mainly due to a decrease in non-essential expenditures and a significant increase in spending on fresh ingredients.

During economic downturns, there is a noticeable reduction in non-essential cultural and entertainment expenditures, coupled with a lack of consumption motivation among the elderly. As a result, the overall scale of private consumption as a percentage of GDP does not undergo substantial changes.

4、 Processed Food and Beverage Retail Exhibits Significant Countercyclicality

Household expenditures on dining out remain higher than those on processed food, but the household consumption of processed food continues to grow.

Consumption trends for processed food by individuals living alone and households with two or more people have not decreased, indicating that the consumption of processed food exhibits strong countercyclicality. Processed food is cost-effective, and consumers tend to reduce dining-out expenditures during economic downturns, especially in Japan, where the cost of labor is high. However, with signs of economic recovery on the macroeconomic front, dining-out expenditures for households with two or more people are expected to rebound. Consumption of beverage products also demonstrates countercyclicality, with low average spending. Health-oriented tea and coffee consumption continues to grow in Japan.

5. Small Families Contribute Significantly to Food Consumption; Frozen Food Processing Business Relies on Retail Growth

Single-person households and two-person households contribute the most to food expenditures, with diminishing marginal benefits as the number of household members increases.

Overall, households with 2-3 people show a strong inclination toward prefabricated food, considering both convenience and cost-effectiveness. Single-person households also contribute significantly to prefabricated food consumption.

The production of frozen prefabricated food has continued to grow from 2009 to 2019, with a more pronounced increase in production volume for frozen prefabricated food intended for direct household consumption.

6. In the Post-Mass Consumption Era, various consumer groups exhibit relatively weak consumption capacity and willingness, marking the arrival of a moment for rational consumption.

- **People aged 60 and above:** Based on cumulative amounts of deposits and liabilities, households with elderly members accumulate the highest net asset amounts. However, as observed earlier, the consumption drive among the elderly is insufficient.

- **Consumers aged 40-59:** The highest spending on consumption comes from households with heads aged between 40-59, born between 1960 and 1980 (the 60s and 70s). Most of them belong to the Bubble Economy generation and the "団块" (団块, or "Danraku," refers to those born in the mid-1960s who played a major role in driving the economy forward) generation.

- The Bubble Economy generation (born in the 60s) entered the workforce just before the bubble crisis. The "団块" generation (born in the 70s) entered society just after the bubble economy era and faced the ice age of employment. Choosing jobs they don't particularly like due to the economic downturn, they began to opt for environments outside of work, embracing de-branding, de-labeling, and rationalization as their consumption characteristics. They are natives of gaming consoles, CDs, manga, and convenience stores. While their consumption capacity might not be too weak due to their parents' early accumulation, their own spending power is not particularly strong.

- **People aged 30-39:** Born between 1980 and 1995, they belong to the "Buddha system" generation. Their parents are mostly from the "新人類" (Shinjinrui) and the Bubble Economy generation. In their youth, they admired high-end consumption but had few savings. They entered the workforce during a period of career setbacks, witnessing their parents' experiences. This led them to pursue stability, resist risks, and opt for rationalization. Different from choosing entrepreneurship, they prefer working in stable large enterprises, leaning towards frugality.

- **People aged 29 and below:** Born in the 90s and beyond, they belong to Generation Z, internet natives who resemble the Buddha system generation. Witnessing Japan's difficult economic situation, their parents are from the "団块" generation. Some daily consumer goods have online sales ratios reaching 40%-50%. However, there are no specific Japanese internet brands; instead, foreign internet giants dominate.

**Summary:**

Japan's weak economic cycle makes it challenging to revive the mass consumption era in an ultra-aging society.

For example, the main consumption cycle for Japan's "New Human" and "Bubble Economy Generation" occurred during the mass consumption period after the maturity of Japan's industrialization. The domestic economic conditions in Japan were prosperous, with strong consumption capacity and a proactive consumption mindset.

2. Division of Consumption Eras and Corresponding Generational Relationships

Economic cycles, ranging from recovery and prosperity to recession and depression, are mirrored in individual consumption characteristics, transitioning from homogeneity to differentiation and ultimately to rationalization. The period during the transition from employment to stability is when consumption capacity and willingness are at their strongest. During this phase, personal spending is robust, gradually shifting towards increased household expenses, and enhanced consumption capacity due to rising individual incomes.

Note the ratchet effect: Consumer habits exhibit irreversibility, with a tendency for habits to shift from frugality to luxury more easily than the reverse. Comparing the younger generation of the New Humans and Bubble Economy Generation to their predecessors, they may not have accumulated much wealth, but their early-formed consumption desires are strong. During the recent economic recovery in Japan, they have resumed pursuing high-end department stores. On the other hand, the children of the Bubble Economy Generation, known as the "団塊" (Dankai) generation, place more emphasis on cost-effectiveness. The subsequent "佛系" (Buddhist) and "Z" generations exhibit more rational consumption habits, leading to a relatively subdued consumer behavior.

Related information