Harvest Capital has been awarded the title of "Top 2 Fund with the Most Outstanding Performance Stability" by Preqin data.

Date: 2022-09-20 Views:

Recently, the globally renowned alternative asset industry data company, Preqin, collaborated with the Beijing Private Equity Association (BPEA) to release the first benchmark report for the private equity and venture capital markets in the Greater China region. The report integrates research data from 210 funds and 75 fund managers.

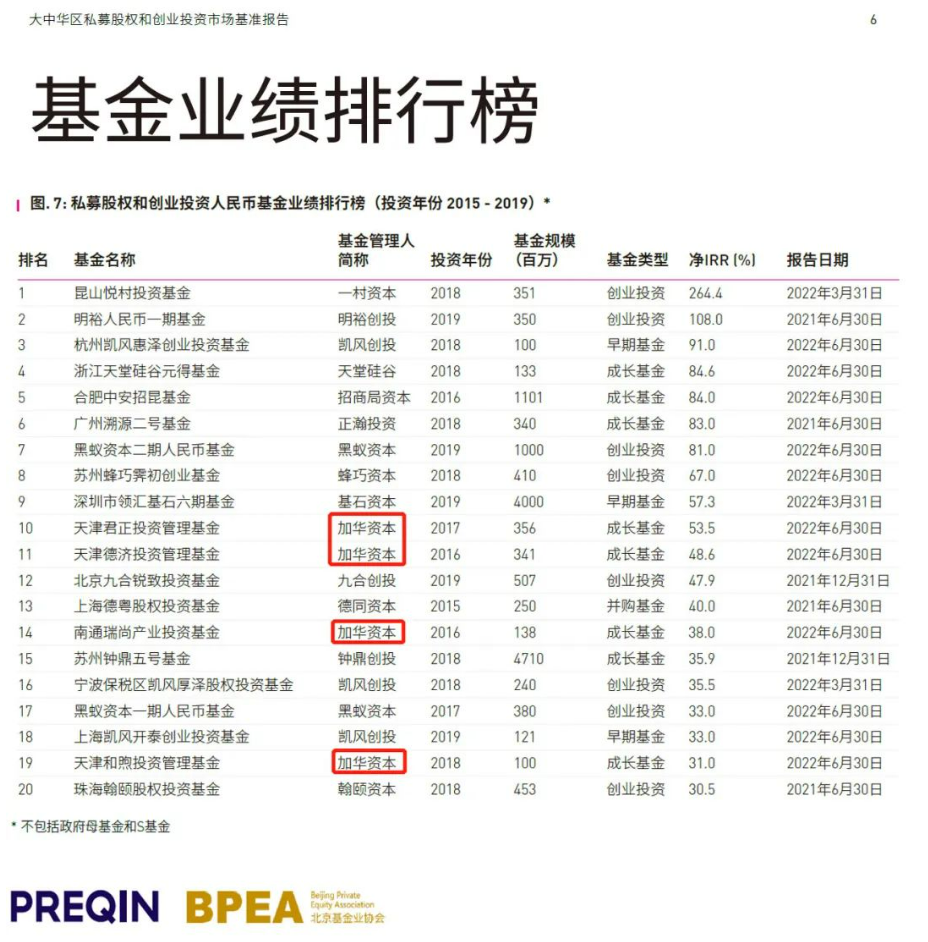

Among the numerous funds and fund managers participating in this benchmark project for the Chinese private equity investment industry, Preqin conducted evaluations at both the fund and manager levels. They compiled rankings for funds in both Chinese yuan and US dollars, highlighting the fund managers with the most outstanding performance stability.

The benchmark performance data aims to provide a comprehensive set of metrics for the market, including but not limited to internal rate of return (IRR), capital called by limited partners (Call), distributed to paid-in (DPI), and residual value to paid-in (RVPI). The rankings are designed to enhance industry transparency by showcasing the best-performing fund managers and funds.

A total of four funds under Harvest Capital entered the Preqin Private Equity and Venture Capital Renminbi Fund TOP 20 list.

In the list of fund managers with the most outstanding performance stability, Harvest Capital ranked second. Among the 17 funds in contention, there were 10 funds in the top performance quartile (top 25%) and 6 funds in the second performance quartile (25%-50%).

Preqin, established in 2003, is a globally renowned platform for alternative asset industry data, market analysis, and investment research. It is utilized by over 200,000 professional investors, covering private equity, venture capital, hedge funds, real estate, infrastructure, private debt, natural resources, and secondary markets.

The Beijing Private Equity Association (BPEA), founded in 2008 and approved by the Beijing Civil Affairs Bureau, is a non-profit social organization.

Below are excerpts from the report.

Related information