Regulators New Regulations Regularize Market, Villager Chicken Expands Nationwide | Weekly News

Date: 2018-07-23 Views:

Spotlight | Hot Spot Focus

The central bank issued a notice on the implementation of the new regulations on capital management: public offering can invest in non-standard transitional arrangements more flexible.

Source: Peoples Bank of China, Wall Street News

Highlights Summary

1) further clarify the investment scope of public asset management products, 2) further clarify the valuation method of relevant products during the transition period, and 3) further clarify the macro-prudential policy arrangements for the transition period.

Interpretation of relevant essence

01/Brokerage China: new rules on capital management, five aspects of unbundling, clear adherence to deleveraging

02/China Investment Bank Club: seven questions and seven answers to the new rules on capital management

03/Investment community: new rules on capital management, VC/PE to understand

The CIRC issued a draft of the banks financial management rules.

Source: China Banking Regulatory Commission official website, Wall Street News.

Highlights Summary

1) Reduce the sales starting point of a single public offering financial product from the current 50000 yuan to 10000 yuan. 2) Standardize product operation and implement net worth management. 3) Requiring financial products to invest in non-standardized debt assets requires term matching. 4) The current bank wealth management business supervision system stipulates that public wealth management products can only invest in currency and bond funds, and the Measures liberalize relevant restrictions, allowing public and private wealth management products to invest in various types of public securities investment funds. 5) The transition period requirements of the Measures are consistent with the New Regulations on Capital Management, and the transition period shall be from the issuance and implementation of these Measures to December 31, 2020. 6) After the end of the transition period, commercial banks may take appropriate arrangements to deal with the stock of non-standardized debt assets that are difficult to return to the table for special reasons, as well as the outstanding stock of equity assets, with the consent of the regulatory authorities.

Interpretation of relevant essence

01/Wall Street: lowering the purchase threshold is good for banks, the stock market will see incremental funds.

02/China Fund News: New rules on wealth management are coming, 22 core rules are all over the table

03/McKinsey released in July: the road to transformation of Chinas large capital management market under new regulations

Shares | Consumption looking ahead

Crime and Punishment in the Age of Communication | Jiahua Viewpoint

On the road of reform and opening up, a new generation of Chinese consumers who have been running for 40 years have gradually taken back the wrench of power from the market. If they wanted to, every time they pulled the trigger, a business would fall with the sound of gunfire.

Businesses dont win on their own, you can only win with consumers.

Who will produce the new rule | Jiahua View

Economic transformation is not only a financial and policy issue, but also a stimulus to the inner spirit of entrepreneurs. The reform and opening up that changed the direction of Chinas economy relied on such a spirit to clarify the direction from the beginning of the reform and work together to open up this road that few people have taken.

After the dark, it is also just before the dawn. As Churchill, who has always been happy to compare the "victory V" gesture, said, "Those countries that fought to the end will rise again, and those that surrendered obediently will eventually perish."

At present, the three most urgent issues are: the sense of direction of the country, the sense of security of the elite, and the sense of hope of the common people.

Source: Nandu Observation

Original Author: SUN Liping

This time its a bit different. This time its like driving on the Gobi or in the desert. The road ahead is very clear, but the road is gone. There is a sand dune in front of us, and the ruts go in different directions., There are shades. Then which one may work in the end, may be a road, which one may not work, it is not a road at all? Now we are a little confused.

What can we do to save our wealth? | Jiahua Share

Source: Luo Shen Catching Demon

The first state of robbery is high taxes. The rulers who reach this state can obtain all the savings of the people, and the income of the people is only enough to survive. Simply put, it is to increase a number of taxes and find ways to make you pay more taxes. Even the so-called tax cuts will change the law to increase taxes.

The second level of robbery is forfeiture. The ruler who reaches this level can obtain all the wealth of the people. The people are already on the verge of life and death. You work hard and eventually all your wealth will be confiscated.

Consumption upgrade under the "market" transformation and upgrading of the road | Jiahua share

Source: Ding Zuyus Comments on the Property Market

Original Author: Kerry Consulting

As a blue ocean industry, Internet companies, technology companies, housing enterprises and traditional supermarkets and other multi-entry. With policy support, the upgrading of residents consumption and the improvement of infrastructure, the industry has a large space for development in the future. The cooling of the short-term real estate market is irreversible. Real estate enterprises seek new business growth points, such as education, pension, long-term rental apartments, etc., as the last kilometer to open up the community, it is of great significance for the transformation operators of real estate enterprises, The market may provide a direction for the new business layout of real estate enterprises.

Family | Business Dynamics

Taikang Group | ranks among the Fortune Global 500 and creates an ecological closed loop of "insurance + medical care".

On July 19, 2018, the Fortune Global 500 list was officially released. Taikang Insurance Group entered the list for the first time, ranking 489th on the list with an operating income of US $24.058 billion, marking Taikangs entry into the ranks of the worlds largest insurance financial services group.

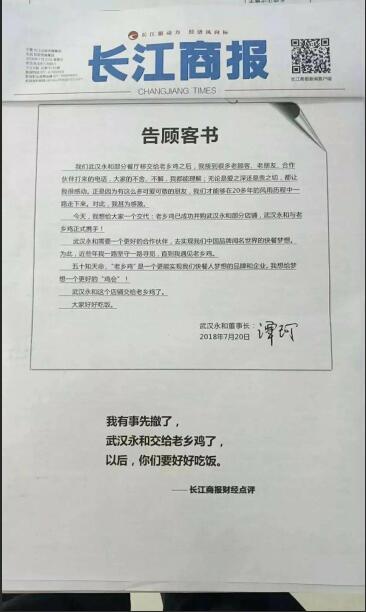

Villager Chicken | Acquires Some Restaurants in Yonghe, Wuhan, Let Wuhan People Continue to "Eat Well"

On July 21, the Chinese fast food chain brand Laoxiang Chicken invested by Jiahua Weiye Capital successfully acquired some restaurants in Yonghe, Wuhan, and the expansion of the national market took an important step.

Mr. Tan Ke has been in business for more than 20 years and has built Wuhan Yonghe into a favorite brand of many consumers. Since the opening of the first store, the villager chicken has been carrying the mission of "catching up with foreign fast food and realizing the Chinese dream"; after more than 10 years of exploration and precipitation, it has begun to move towards the whole country, and nearly 100 new stores have been opened in Jiangsu and Hubei in just two years. Direct store. Together, we will create a new era of Chinese fast food chains.

Related information