CHINA FOOD 2018: "Insert invisible wings for catering brands!" | Industry Focus

Date: 2018-03-26 Views:

From March 22 to March 24, the "CHINA FOOD 2018 Shanghai International Food and Beverage Alliance Exhibition" jointly sponsored by the Chinese Food and Beverage Authority-China Cuisine Association and the overseas Education College of Shanghai Jiaotong University, a well-known business school in China, was held in the Shanghai World Expo Exhibition Hall.

Su Wenjun, partner of Jiahua Weiye Capital, was invited to attend this franchise exhibition and gave the first speech entitled "Inserting Invisible Wings to Catering Brands" at the "Capital and Catering Special Summit Forum.

So far, the "CHINA FOOD Shanghai International Catering and Food Alliance Exhibition" has been successfully held for five sessions. As a highly influential industry event in the field of Chinese catering chain franchise, it has not only built a unique catering exhibition sharing platform, but also integrated the ecology. Rich industrial resources have effectively promoted the development of the industry and have served thousands of high-quality catering chain brands at home and abroad.

The reason why the organizers invited Jiahua Weiye Capital to make the first speech of the forum is to value its industry grasp and "industry deep cultivation" ability. For more than a decade, Jiahua Weiye Capital has adhered to the concept of value investment, focusing on equity investment in the field of large consumer services, especially in the consumer segments such as big home, big catering, big food, big clothing and other consumer segments to establish an absolute leading professional advantage. With its own professional financial tools, collaborative industrial ecology, systematic management standards and other comprehensive "post-investment service capabilities", it continues to lead the branding and intensive transformation of Chinas consumer service industry.

In the catering industry, Jiahua Weiye Capital successfully invested 0.2 billion yuan at the beginning of this year in the "hometown chicken", which is the "leader" of Chinese fast food and has more than 400 direct stores across the country. This is the first time that the hometown chicken has accepted capital since its establishment 15 years ago. Market investment. Jiahua Weiye Capital is helping the hometown chicken to continuously improve the corporate governance structure, increase the internal system upgrade and transformation, so that the brand influence, channel layout from the corner of Jiangsu and Anhui successfully to the whole country.

On January 22, 2018, Jiahua Weiye Capital and Hometown Chicken completed the signing of a contract on equity investment cooperation between the two parties. Song Xiangqian, chairman of Jiahua Weiye Capital, and Shu Congxuan, chairman of Laoxiang Chicken Group, shook hands cordially after signing the investment agreement. Hefei Vice Mayor Wang Minsheng and other government leaders witnessed this moment.

Earlier in October 2015, Jiahua Weiye Capital also invested 0.15 billion yuan in the national healthy breakfast brand "Barbie Steamed Bread". With the help of capital, "Barbie Steamed Bread" has developed rapidly in the past two years. At present, the number of stores nationwide has exceeded 2200, and the annual sales have exceeded 2.2 billion yuan.

On October 21, 2015, Jiahua Weiye Capital and Barbie Steamed Bread completed the equity investment contract. Song Xiangqian, Chairman of Jiahua Weiye Capital (fifth from left), and Liu Huiping, Chairman of Shanghai Zhongyin Group and founder of Barbie Steamed Bread (fourth from right) toast to celebrate.

Review of "Invisible Wings for Catering Brands" Keynote Speech "Dry Goods:

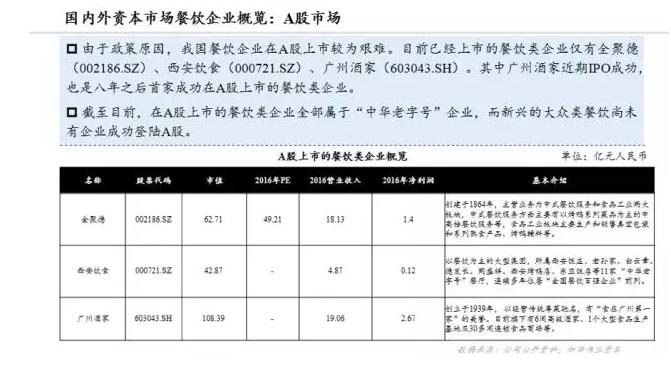

Up to now, all the catering enterprises listed in A- share belong to "China time-honored brand" enterprises, while none of the emerging mass catering enterprises have successfully landed in A- share.

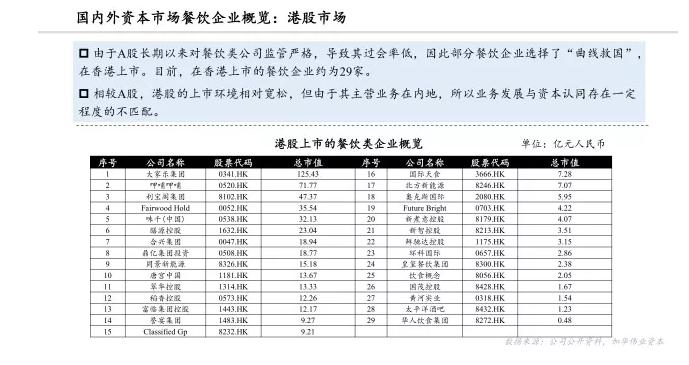

Due to the strict supervision of A- share catering companies for a long time, resulting in a low passing rate, some catering enterprises have chosen "curve to save the country" and listed in Hong Kong. At present, there are about 29 catering enterprises listed in Hong Kong.

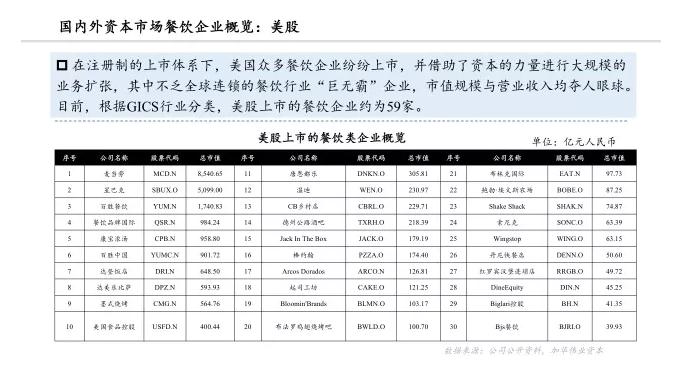

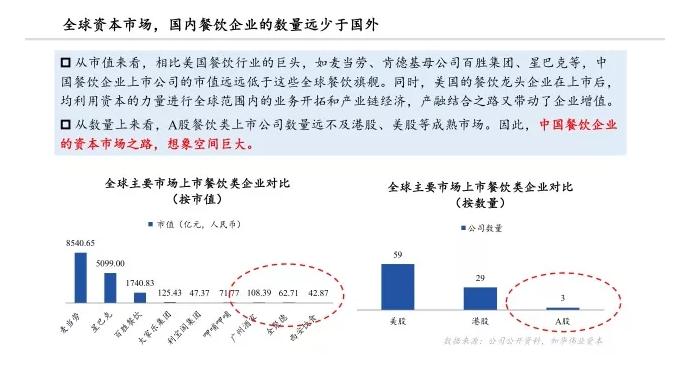

Under the listing system of the registration system, many catering enterprises in the United States have been listed one after another, and have carried out large-scale business expansion with the help of capital. Among them, there are many "giant" enterprises in the global chain catering industry, whose market value scale and operating income are eye-catching. Currently, according to the GICS industry classification, there are about 59 catering companies listed on the U.S. stock market.

The number of A- share catering listed companies is far less than that of mature markets such as Hong Kong and U.S. stocks. Therefore, the road to the capital market of Chinese catering enterprises has huge imagination.

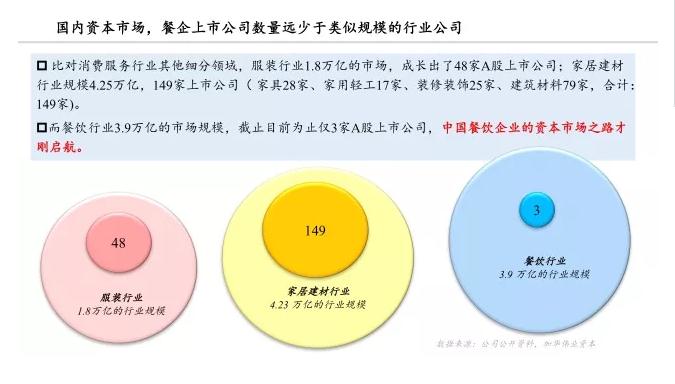

Compared with other segments of the consumer service industry, the 1.8 trillion market in the clothing industry has grown 48 A- share listed companies. The scale of the home building materials industry is 4.25 trillion, with 149 listed companies (28 furniture, 17 household light industry, 25 decoration and decoration, 79 building materials, totaling 149).

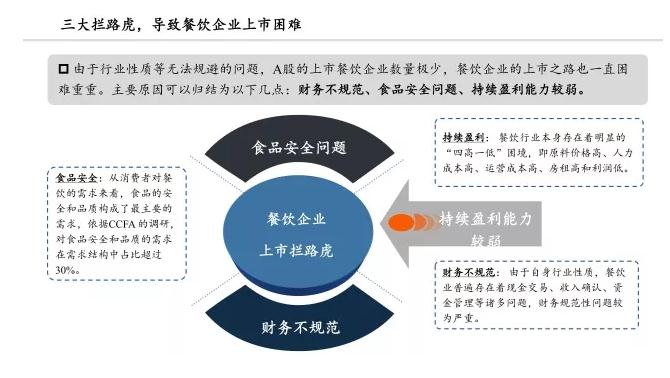

Due to the nature of the industry and other unavoidable problems, the number of A- share listed catering companies is very small, and the road to listing of catering companies has always been difficult. The main reasons can be attributed to the following: financial irregularities, food safety issues, and weak sustainable profitability.

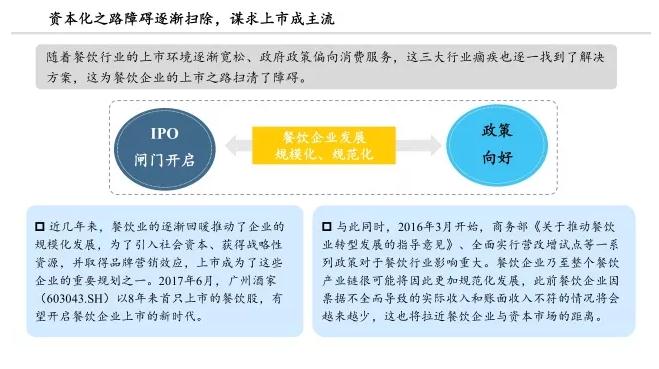

With the gradual relaxation of the listing environment of the catering industry and the governments policy favoring consumer services, these three major industries have also found solutions one by one, which has cleared the way for catering companies to go public.

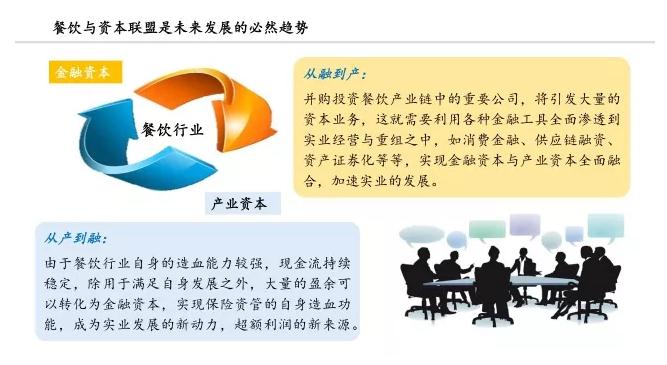

The full integration of financial capital and industrial capital has accelerated the development of the real economy.

Conclusion:

The will to focus is the investment values that Jiahua Weiye Capital has always adhered. We believe that entrepreneurs should find the right target, cultivate the industry with constant patience, and be pushed to the top of the wave when the wind comes.

Related information